What motivates the financial decisions of urban poor households?

Photo by Saranya Loisamutr on Shutterstock

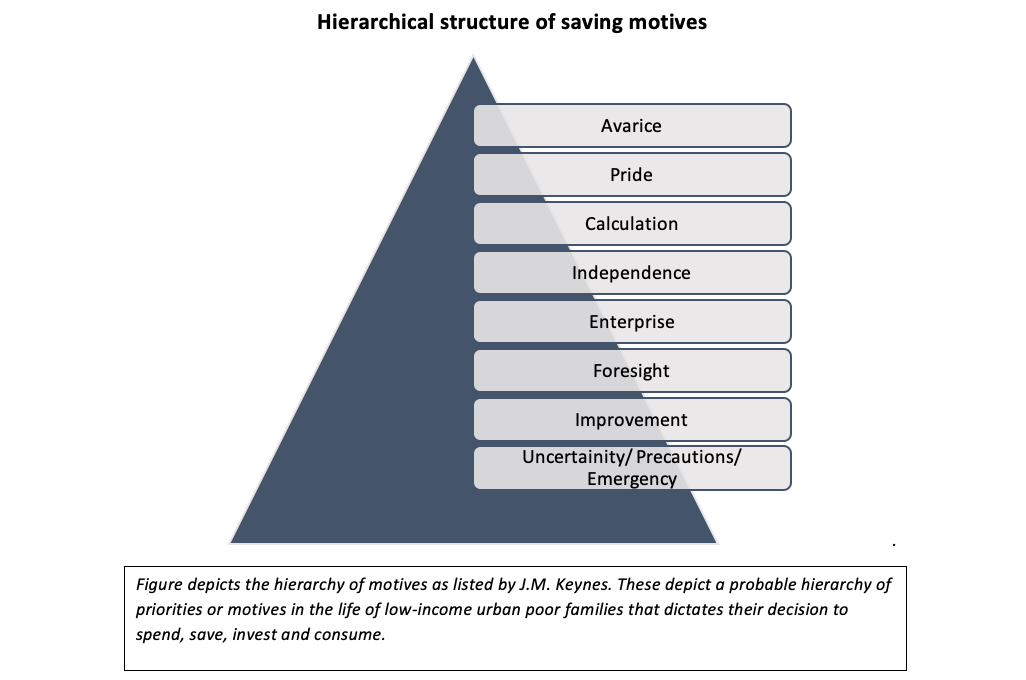

Research on motivations to spend or save has been of both theoretical and applied interests. Multiple disciplines have attempted to decode the mechanics of spending or saving by individuals and households using different lenses to the same question — how, why and when do individuals spend or save? Researchers have tried to situate the habit of savings in psychological or behavioral contexts to understand various facets of human behavior like influence of personality traits, risk preference, self-control, ability to delay gratification, and various other factors (Webley et al., 2000). One of the well-recognized subjective theories that examines individual’s propensity to consume was postulated by J.M. Keynes in 1936. Keynes’ analysis of understanding the propensity to consume lists down 8 motives to save money or refrain from spending. Based on preliminary findings from our pilot survey to understand the financial lives of urban poor and empirical observation, this blog attempts to reorganize these 8 motives in a form of hierarchy of spending, saving or consumption priorities of low-income households (LIHs) as well as discusses contextually relevant empirical evidence from the field.

Unlike households with members engaged in employment with predictable earnings, urban poor families live on multiple sources of earnings with differing frequencies of payment (ranging from daily wages to once in two months) as well as uncertain incomes. As a survival strategy, LIHs tend to first prioritize protection measures (both proactive and reactive measure) to safeguard against income uncertainties or sudden out-of-pocket expenses due to illness or death in the family, thus forming the base of the pyramid. This motive shapes their propensity to build up reserves against unforeseen contingencies. Next comes improvement, a motive that ranges from improving the standard of living (like renovating/ extending their houses or earning higher income) to timely payment of school fees. In certain families where, multiple generations live under the same roof, foresight tends to be the next motive that determines cash flows within the households. Having foresight would lead to providing for anticipated differences in income and expenses, particularly from a long-term lifecycle perspective[i] while accounting for maintenance of dependents. Next, enterprise motive refers to carrying out speculative or business activity by investing money if and when available and possible. For an LIH, enterprise motive is not driven by entrepreneurship skills but is influenced by the need to maximize returns from an occupation. The motive of acquiring independence refers to attaining agency and autonomy thus building the confidence to pursue goals without being a liability to others. In theory this motive has been studied in the context of financial agency exerted by women in LIHs by the virtue of being members of joint liability group loans as well as self-help groups. Calculation motive refers to earning an interest or appreciation, i.e. a larger real consumption at a later date is preferred to a smaller immediate consumption. In our understanding, calculation motive for a LIH could be better understood by their interaction with financial services, under the assumption that households will make rational choices and have complete understanding of comparative returns from various financial instruments. The last two motives of spending for satisfying the feeling of pride and avarice are the lesser observed motives among LIHs, probably because of their ownership of limited resources and their position in the society. Broadly the motive of pride refers to leaving behind a large inheritance and is also known as the bequest motive. Among the rural low-income households, this motive would be lower in the hierarchy as they actively invest in physical property that serve as asset to further generations. However in urban poor context, property may not be owned or ownership may not be a sign of permanency for future generations to reap benefit from it. Lastly, avarice refers to being miserly which assumes that there are enough resources left after the other motives have been satisfied. In case of LIHs, they are continuously trying to optimize their expenses in a cost-effective manner, which may make them prudent at cash management but not necessarily miserly. This is also validated by the regular expenses incurred by LIH towards festivals, rituals and other community-based events thus providing evidence against avarice[ii] being a motive.

Competing households needs

This hierarchy attempts to explain the principles that steer intrahousehold cash management over various time horizons and competing needs. Interestingly, urban poor households are sometimes trying to simultaneously juggle multiple motives like build precautionary reserves to avert uncertainties (eg — by reducing consumption when faced with illness in the house), ascertain and improve liquidity for daily expenses as well as build a lumpsum for starting an enterprise. Clearly, not all motives can be satisfied by the unsteady and unpredictable flow of income and contractual nature of employment. This is where financial instruments, both indigenous and institutional, enter the lives of LIHs, but not in the way they exist in the lives of salaried or middle-income families. For instance, preliminary findings of our pilot show that urban poor families prefer to park their money in weak[iii] commitment saving and borrowing models like chit funds (also known as ROSCA). This is interesting and surprising at the same time because not only is the design of chit funds complicated and sophisticated, but it also requires disciplined contribution for short to medium term duration. The advantage of chit funds is that the contributor has access to lumpsum money in any month during the tenure of the chit cycle. To understand this better let’s briefly discuss why is chit preferred over bank loan or Microfinance group loans.

Why chit funds?

Chit funds is a unique financial instrument that enables households to mobilize huge amount of small savings and in return gives them access to lumpsum amount that they would not have been able to get from banks or safely accumulate at home. This is possible because membership into a chit fund group is not tied to any particular goal like consumption purpose or productive purpose. Members can save either to build lumpsum for starting an enterprise or for arranging need-based liquidity, the motive doesn’t matter as long as they are able to contribute the amount. Group dynamics somewhat ensure that not every member will auction every month i.e. require lumpsum amount every month. Every contribution is a step towards building-up resources one month at a time. In comparison to bank loans, chit funds require less documentation, are flexible about collateral, charge no rate of interest (technically there is negative rate of interest), are cheaper than loans from moneylender, allow easy withdrawal and provide guaranteed access to lumpsum (although that is lower than the total amount contributed due to Foreman fees[iv]). From an investment perspective, chit funds could be preferred over mutual funds and shares because of shorter and flexible lock-in period and guaranteed returns. In addition to these advantages, chit funds also inculcate the habit of disciplined savings. Literature shows that these funds are usually used for consumption needs, to repay old debt, accumulate working capital, create liquidity for emergency or retirement, lend to other borrowers (thus reinvest) and use for both time-sensitive and non-time sensitive needs[v].

In this context it would fascinating to delve deeper into some questions like –

a. Do savings or investments habits by low-income households that experience income volatility follow a sprint pattern instead of a marathon, wherein households prefer to save small amount periodically instead of locking in money for longer periods in term deposits?

b. Do LIHs have a higher propensity to save when it gives them easy and quick access to lumpsum money, even if it means to lose some money on the table in form of fees and penalties for withdrawing early?

c. Is there an opportunity to create a database for financial instruments like chit funds, saving groups that could be reviewed and adopted by formal institutions?

References:

1. Keynes, J. M. (2018). The general theory of employment, interest, and money. Springer.

2. Webley, P., Burlando, R. P., & Viner, A. (2000). Individual differences, saving motives and saving behaviour: A cross-national study. Fairness and cooperation, 497–501.

[i] The position of foresight in the hierarchy may change as per family structure and income certainty.

[ii] However, in context of urban poor avarice may take form of theft, gambling and other crimes.

[iii] They are called weak commitment saving models as they aren’t tied to a specific goal like paying school fees or expanding business

[iv] Foreman fees or commission is a percentage (usually 5%) of the chit value which is the primary source of income for the chit fund company.

[v] The downside of chit funds arises when multiple members require the lumpsum amount before in the same month. In such situations, member borrow from expensive loans from local moneylenders.

This research was developed as part of the Bharat Inclusion Research Fellowship.