Ration shops with a banking rationale?

Photo by Saurav022 on Shutterstock

Usually financial habits of a household are gauged through their cash management strategies, income-expense flows, investment in human capital, stock of physical and financial assets, borrowings, and transfers. In our ongoing survey of slum households in Chennai, we captured these details through an initial survey and conducted follow-up interviews with these households using a financial diary methodology, thus creating a panel survey of urban poor households. One of the results that I observed through the survey were the households’ strong dependence on local ration shop a.k.a Public Distribution System shops (PDS shops)/ Fair Price Shops (FPS) for their monthly supply of staples, pulses, etc. This is not surprising as the public distribution system was set up for ensuring minimum food security for the low-income households, and efficiency of Tamil Nadu’s PDS machinery may be one of the strongest in the country. However, it is interesting to revisit the existing role of PDS shops in the lives of low-income households, and reimagine it’s potential to move the needle on financial inclusion.

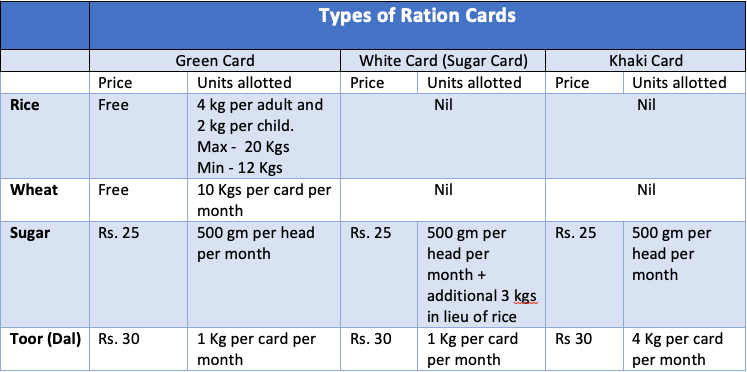

Since 2017, the Government of India has mandated all states to use the Aadhaar-based biometrics as an identification tool for the beneficiary as well as an effective way to control leakage through better records of sales, stock and integration with electronic weighing machines. In Tamil Nadu, the government steadily implemented e-PDS through the conversion of ration cards into smart cards. The smart card reflects the beneficiary’s original ration card colour where the colour signifies the entitlement to a set of commodities. For instance, there are 5 kind of ration cards in Tamil Nadu and each of them provide beneficiaries access to a different set of entitled commodities. We conducted an unstructured survey of a few ration shops, to verify if the details on the official PDS web portal were matched with onsite rates and allocations. Based on the findings, a snapshot of the commodity list and price list is as below.

Details on Ration card supplies in Chennai

In Chennai, a green card holder availing allotted subsidized commodities spends around Rs 105 and a white card holder spends Rs. 180 on a monthly basis. These amounts reflect small volume of transactions but expenditure incurred at PDS shops may not be an indicator of overall spending capacity of the households. In our survey, on an average slum households undertook consumption expenditure of food items worth Rs. 1700 (excluding cooking fuel).

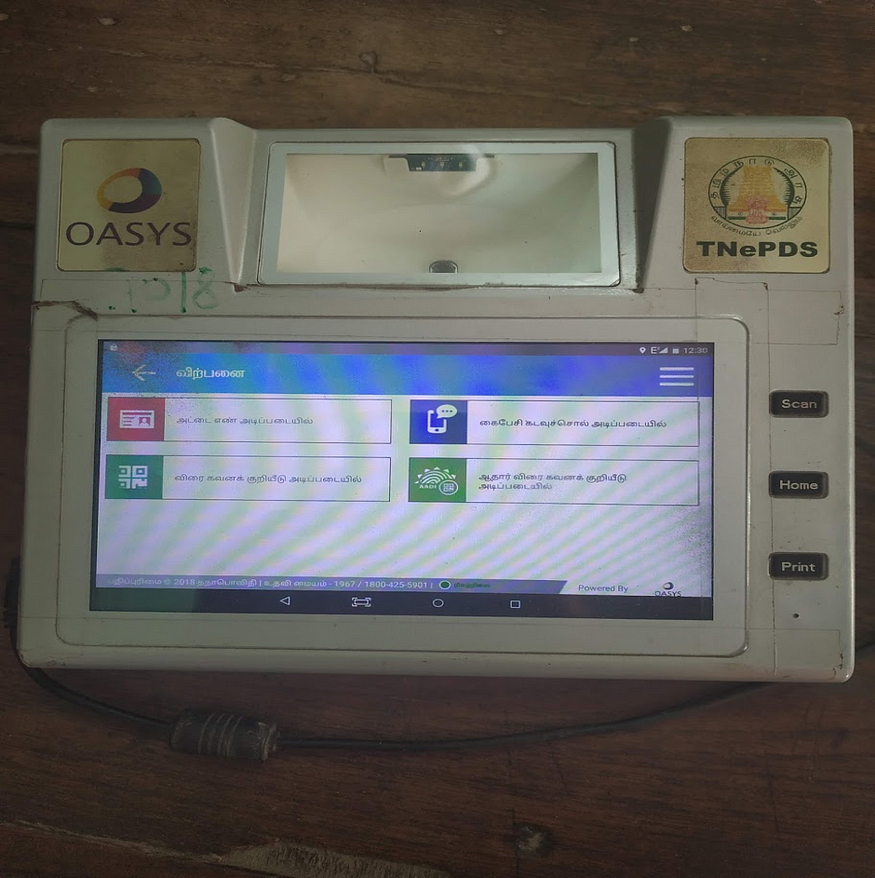

We will soon get to the point of why are we discussing this. But before that let’s walk through the process of buying commodities using a smart e-PDS cards (smart card as said colloquially). In Chennai, a smartcard holder needs to present their QR coded smartcard at PDS shops [2]. The smartcards have details on family member names, residential address, photograph, date of birth and a code which indicates the commodities allotted to the family or individual. This code denotes the original colour of the hardcopy card, i.e. each code signifies whether it is equivalent of a green, white (sugar card), khakhi, AAY or forest official card. The Fair Price Shop (FPS) personnel scans the card using e-PoS machine (as shown below) which reads the cards and reflects the available balance of commodities for the card holder. The FPS personnel enters the commodities being issued by swiping the card and quantities are automatically deducted from the card. The card holder pays in cash [3] and the receipt is sent via SMS to the registered mobile number of the card holder. At the end of the day or next day, the FPS personnel either deposits the money in a nearby nationalized bank branch to the civil supplies bank account, or they manually submit it to the locally appointed collector. Currently Tamil Nadu uses non-biometric cards to identify and authenticate the borrowers, surpassing the need to use Aadhaar as a mode of identification and authentication [4].

The efficacy of the smartcard in Tamil Nadu or Aadhaar enabled card in other states is being widely debated as there are concerns on denial of services due to poor internet connectivity and malfunctioning of card readers and e-PoS systems. However the e-PDS system may have a potential to provide banking service to the last mile customer.

Non-biometric Smartcard Reader for ePDS distribution in Tamil Nadu

A new proposal — leveraging existing infrastructure

As on 2018, there are 5.34 lakh fair price shops active and operational in India [5] out of which 3.61 lakh FSPs have e-PoS devices in 29 states and territories. These figures serve as an indicator of scale of e-PDS presence particularly in areas with greater number of PDS beneficiaries. As per government records [6], there is 100% digitization of ration cards in all 36 states and union territories, including issuance of both biometric and non-biometric smartcards. Is it then possible to leverage the ubiquitous network of PDS shops, e-PoS machines and e-PDS smartcards for providing financial services to the last mile customers or to re-imagine the mode of transaction from cash-based to digital based transaction for the PDS beneficiaries?

Thought experiment

To my mind, two kinds of ideas stem from here. As a solution to introduce digital mode of transaction for PDS beneficiaries with non-biometric smartcards, the card could be converted to a smartcard plus prepaid card (with PIN) which can be loaded with money to undertake closed loop transaction only at ration shops. For Aadhaar enabled biometric smartcard holders, the fingerprint scanner can facilitate account to account transfer. This new card will serve two purposes — a) monthly payments for ration could be done digitally, b) the shopkeeper does not have to deposit the cash at end of day (at least for the beneficiaries that undertake payment using the card). However this can be a time-consuming process as it will require strategic collaboration between Ministry of Consumer Affairs, Food & Public Distribution, banks, card issuing companies and e-POS/ m-POS machines. Nevertheless, use of such combo cards can serve as a gateway to digital way of transaction, albeit only at PDS shops.

The second route of integrating financial service delivery with PDS is a broader idea of on-boarding e-PDS merchants as banking agents. As a state-run retail shop with subsidized items, PDS shops can converted to banking agents/ business correspondents. These e-PDS shops could enable customers to make payments for utilities, small-value cash deposit and withdrawals using Aadhaar enabled payment systems as well as conduct domestic remittances. Leveraging existing networks and infrastructure can improve access as well as lower the marginal cost of setting up a banking agent vis-à-vis individual agents.

Currently there have been only two instances of private banks on-boarding e-PDS shops as banking agent in India — Yes Bank and IDFC Bank [7] [8]. Both the banks aim to integrate e-PDS shops with financial services using Aadhaar enabled payment services (AePS). However, the opportunity to leverage on the e-PDS network for expanding financial access points for the masses comes with the challenge of the type of smartcards used in different states. While on-boarding them as banking agents and taking advantage of their far-reaching e-PDS infrastructure, financial service providers would need to be cognizant of both biometric and non-biometric smartcards used by different states.

Low income households are already familiar with e-PDS shops in their locality and make frequent visits to them typically on a monthly basis. Therefore, integrating financial services through e-PDS shops holds the potential to mitigate access barriers and other non-financial barriers associated with brick and mortar bank branches, as well as aid on-boarding of households across the spectrum onto digital modes of transaction.

Beyond these 3 types, there is also the Anthyodaya Anna Yojana (AAY) cards and the Forest official cards. AAY card holders are entitled to 35 Kgs of free rice and maximum 2 kgs of sugar at a rate lower than that of sugar (white) card holders. Apart from this there is a separate white card with no entitlements and is used as an address and ID proof by the card holders.

Beneficiaries have converted their paper cards to smartcards either through online application forms or through submission of offline application forms at civil supply headquarters in the town. Typically the beneficiary requires an Aadhaar card/ electricity bill/ house agreement in addition to the ration card for e-PDS smartcard application.

Largely, shops did not support payment via card or any other digital payment system in Chennai

These smartcards are bar coded and an additional layer of authentication layer is added to it by assigning a smart card pin or by sending a one-time OTP to the registered mobile number.

References and Endnotes

[1] Beyond these 3 types, there is also the Anthyodaya Anna Yojana (AAY) cards and the Forest official cards. AAY card holders are entitled to 35 Kgs of free rice and maximum 2 kgs of sugar at a rate lower than that of sugar (white) card holders. Apart from this there is a separate white card with no entitlements and is used as an address and ID proof by the card holders.

[2] Beneficiaries have converted their paper cards to smartcards either through online application forms or through submission of offline application forms at civil supply headquarters in the town. Typically the beneficiary requires an Aadhaar card/ electricity bill/ house agreement in addition to the ration card for e-PDS smartcard application.

[3] Largely, shops did not support payment via card or any other digital payment system in Chennai

[4] These smartcards are bar coded and an additional layer of authentication layer is added to it by assigning a smart card pin or by sending a one-time OTP to the registered mobile number.

[5] http://pib.nic.in/newsite/PrintRelease.aspx?relid=186388

[6] http://pib.nic.in/newsite/PrintRelease.aspx?relid=160051

This research was developed as part of the Bharat Inclusion Research Fellowship.