Insuring Bharat: Q & A on Indian Mutuals

Photo by Uplift Mutuals

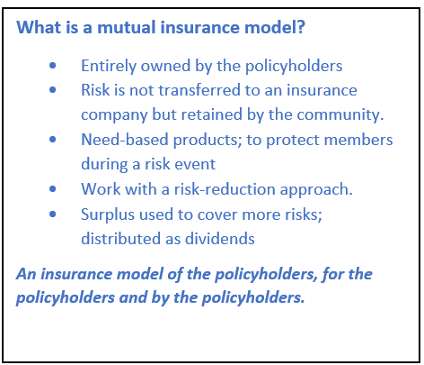

In this blog, we discuss emerging insights from our current study on mutuals in India and try to answer frequently- asked questions on mutuals.

Which are these organisations running mutual insurance?

Till now, we have identified 21 mutual insurers in India, who meet our definition of a mutual (see text box). These include Microfinance Institutions (MFIs), SHG Federations, Cooperatives, professional associations of Doctors and members of a specific religious community.

Why did communities start their own mutual insurance?

Most mutuals, catering to the Bottom of the Pyramid (BOP) started due to market gaps or market failures. Key factors driving their origin were: non-availability of appropriate products in the market, increasingly unviable premiums of commercially available products and tedious claim settlement processes of insurance companies; and need for a transparent and accountable risk management system. For instance: Uplift Mutuals was started in 2004 to address a gap in the health insurance product offerings of commercial insurance companies. Most of these mutuals organise their annual general meeting where the member policyholders get a platform to give feedback, elect representatives and decide on policy matters.

When did they start and what is their scale?

Most of these mutuals were found to cater to low-income households started between 2004–10. This was because many SHG federations had matured, small and large MFIs were growing exponentially — the structures of these microfinance organisations were used to distribute mutual insurance. Moreover, women through these SHG federations and MFIs had experienced handling money (savings & credit) and were ready to take the next leap into insurance. Mutuals serving middle- and high-income households are much older, the oldest being Calcutta Hospital and Nursing Home Benefits Association which was started pre-independence.

These Mutuals varied significantly in terms of scale — large mutuals like DHAN Foundation have more than half a million member households insured covering 2.65 million people; similarly Anapurna Mahila Credit Cooperative Society provides life, health and asset insurance to more than 100,000 members in Pune and Mumbai, whereas Self Help Promotion for Health And Rural Developments (SHEPHERD) in Tamil Nadu runs a small and sustainable health mutual with 15,000 members.

What is the geographical spread of these mutuals?

Mutuals were seen to be concentrated in Southern and Western India, because these are regions with a relatively well-developed microfinance sector. We have not found any mutual in the North East. Mutuals are present in Maharashtra (9) Tamil Nadu (4), Telangana & Andhra Pradesh (3), Gujarat (2), Kerala (2), West Bengal (1), Rajasthan (1), and Odisha (1).

What are the products offered by these mutuals?

Mutuals can design and offer a product based on the risk profile and demand from their members. Most of the ones covered in our study offer health, credit life and life insurance products. Goat and asset insurance are the other products being offered. Apart from the above, some of the products being developed are in fisheries, piggery and poultry.

Are these mutuals sustainable or do they run on purely altruistic motives?

All mutuals identified as part of our study are financially sustainable, with adequate premiums for paying claims. It took about 5–8 years for these 21 mutuals to break-even in terms of covering initial investments on MIS, setting up processes, risk reduction services, capacity building of staff etc. Some of the mutuals have advanced technological solutions and practice data driven decision making that aids to their sustainability

This research was developed as part of the Bharat Inclusion Research Fellowship.