Empowerment through Experience

Customer service and grievance management are critical challenges to the financial inclusion effort in India. As such, customer service and grievance management are key determinants of any bank’s relationship with their customers. Positive experiences of service and grievance redressal encourage customers to trust banking service providers and thereby, inspire loyalty.

However, in the Indian context, many times poor service or unavailability of service from banks leave customers jeopardized, and with no hope. Many in rural parts of the country experience innumerous service related issues from banks, but most of their complaints either go unreported or remain unresolved. Consider the case of Chandan, for instance.

Meet Chandan

Photo by Hari Mahidhar on Shutterstock.

Chandan is a farmer who lives in the countryside of Orissa (an Indian State). Chandan holds a bank account and buyers often transfer payments directly to his account. Chandan uses cash to make necessary arrangements for the harvest season. In order to fulfil his cash requirements, he prefers to take a loan from a bank, as private lenders in the village charge higher rates of interest. For Chandan, reaching the nearest bank is not easy as the branch is at the Gram Panchayat level, at a distance of about 20 kilometers from his village. However, he is compelled to make multiple visits to the bank to make sure his loan is sanctioned on time. Recently, his bank debited the loan EMI from his bank account twice in the same month. Harvest season is at its peak and Chandan cannot afford to take time out to visit the bank and get his complaint resolved.

The bank’s customer service and grievance management infrastructure in its current shape is too inadequate to effectively serve Chandan. This inadequacy prompts one to explore whether and how emergent digital technologies can be harnessed to bridge the distance between customers like Chandan and banks, and uplift customer experience. In this blog, we take a look at the potential solutions offered by open banking.

Reimagine Customer service through Digital Technology

Now, to be clear, digital technologies alone cannot enable financial inclusion of the under-served segments in India. Digital financial services will benefit under-served segments of the population only when they are supported by well-developed payment systems, good physical infrastructure, appropriate regulations, and vigorous consumer protection safeguards. And whether digital or analogue, financial services must be tailored to the needs of disadvantaged groups such as women, socio-economically underprivileged individuals, and first-time users of financial services, who may have low literacy and numeracy skills.

According to the World Bank Global Findex Report, 2017, two-thirds of unbanked adults worldwide, have a mobile phone. Having a mobile phone can open access to mobile money services and many other financial services. Having access to internet connectivity expands the range of possibilities. As per TRAI Telecom Subscription data, the Wireless Tele-density in India increased from 86.89 % at the end of May-18 to 88.00% at the end of Jun-18. Governments are also taking initiatives to build the digital infrastructure in states like Chhattisgarh with ambitious schemes like the ‘Sanchar Kranti Yojana’ (SKY), which aims to distribute 5.5 million smartphones free to women in rural areas, students and urban poor in an attempt to bridge the digital divide.

However, despite improved access to digital technologies, unlike urban and digitally literate customers, rural customers continue to remain excluded from on-time service support from banks. Digitally literate or urban customers are fully leveraging digital banking channels to access best services from their banks. But customers like Chandan, who live in rural areas with limited infrastructure and facilities to connect with their bank have been unable to upgrade their experiences.

Customer Service 2.0 with Open-Banking Technology

Open-banking has the potential to change this. Open-banking will revolutionise customer service and grievance management in ways that are yet to be imagined. It will do so by (i) on-boarding third parties with dense customer outreach into the banking ecosystem, (ii) enabling access to customer information to such entities, upon consent, via APIs and (iii) channelling delivery of customer service and grievance management services to hitherto estranged segments of the population via networks of third party service providers.

A host of open-source Application Programming Interfaces (APIs) like eKYC, eSign, Unified Payment Interface (UPI), DigiLocker, and Aadhaar Enabled Payment Services (AePS) have been developed in India over the years. Various organisations, startups, Fintechs etc. are utilising these open source APIs to provide simple solutions to customers and are very much accepted in the market. This clearly demonstrates the prospects of open-banking in the Indian market.

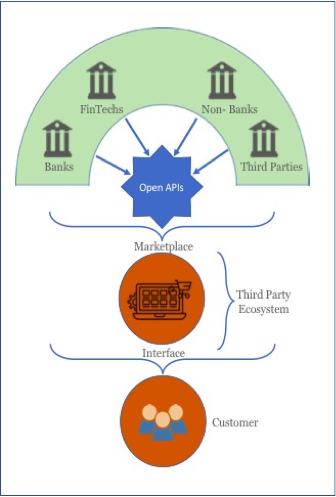

Open-banking will create a sort of ecosystem wherein Banks, FinTechs, Non-Banking entities etc. are connected to a marketplace through secured open APIs, and can give direct access to customer information to third party service providers like retailers, telecom service providers, logistics companies etc. These marketplaces can innovate their own service models to provide better services to customers on behalf of banks. A picture of what open-banking enabled customer service delivery could look like in the following figure.

Imagine a service point in a village with a computer and internet connection, integrated with all banks, raising and resolving customer grievances using a single interface. The service point owner could be an agent of any third party, a trusted non-banking entity, who uses open APIs of different banks and directly acts as a customer support agent for customers like Chandan and others.

Today, when a rural customer goes to a Mandi or Haat to buy household items, the fact that all items are available at a common marketplace is a source of ease and comfort to the customer. Now think, what if open-banking can create a similar mandi, a marketplace of third party entities providing various financial products and customer support services on behalf of banks. Customers will no longer have to travel long distances to visit banks and will be able to utilise open banking enabled banking points that connect thousands of villagers to their banks from a single point.

In their study, Antonique Koning and Gayatri Murthy write that customers engaging in the financial services market are empowered when they-

(i) have access to a wide range of choices in product and service options,

(ii) feel like they are treated with dignity and respect regardless of their socio-economic background,

(iii) are heard by service providers and encouraged to voice their opinions, and

(iv) are able to exercise greater control over their use of financial services.

Empowered customers have greater control over their financial lives and hence, are ultimately good for business. By customising solutions as per the needs of the under-served segments of the population in India, and by taking customer service and grievance redressal to their doorsteps, open banking will create superior customer experiences and thereby render an empowered base of consumers.

References:

Demirguc-Kunt, A., Klapper, L., Singer, D., & Ansar, S. (2017). The Global Findex Database 2017- Measuring Financial Inclusion and the Fintech Revolution. Washington: The World Bank.

Murthy, G., & Koning, A. (2017, August). Customer Empowerment in Finance. Pespectives, 3. Retrieved from http://www.cgap.org/sites/default/files/Perspective-Customer-Empowerment-in-Finance-Aug-2017_0.pdf

This research was developed as part of the Bharat Inclusion Research Fellowship.