Comparing Reality vs. Theory: Indian Mutual & Cooperative Insurers

In this blog, we discuss the findings of a survey conducted with members of mutual and cooperative insurers in the three Indian states — Gujarat, Maharashtra and Tamil Nadu (states with the highest density of mutual and cooperative insurers).

This blog compares typical characteristics of mutual and cooperative insurers versus actual on-ground observable evidence, to better ascertain the state of Indian mutuals.

___________________________________________________________________

Theory: Mutuals are member-owned and were created to serve the common interests of their members.

Reality: We found that 100% of the mutual & cooperative insurers surveyed were member owned, and members playing an active role in governance. More than half of the members across organisations have participated in atleast one Annual General Body Meeting (AGM) in the last three years.

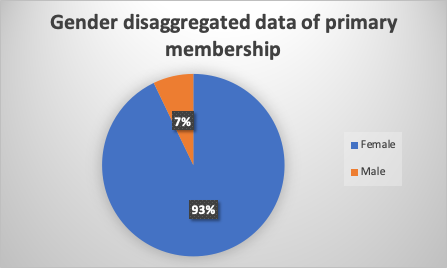

From an inclusivity perspective, a positive sign was 93% of primary members being women — which we believe is also representative of the general gender participation mix in the larger population of mutual and cooperative insurer membership base. These women have organized themselves as cooperatives, SHG Federations and Public Trusts and over time introduced insurance services to protect themselves against some shared risks.

___________________________________________________________________

Theory: The mutual focus is to design and deliver need-based products; to protect members during a risk event.

Reality: We found mutuals catering to insurance needs of the community that were not met by commercial insurance companies. In the villages of Tamil Nadu, a mutual provided goat insurance to its members, goats being an important source of supplementary income to low income households in the area. Livestock insurance products offered by insurance companies are primarily limited to milch animals such as cows and buffaloes. A cooperative insurer in Ahmedabad provided hospital cash insurance. Unlike market-available products, children were also covered in the hospital cash product since parents in this target segment(low income households) were found to lose wages when children are hospitalised.

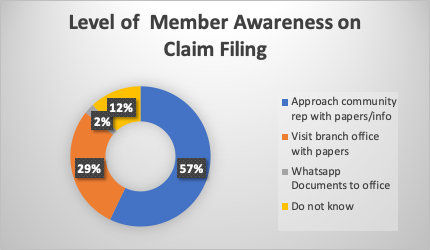

Members had high awareness levels about claims process. About 88% of members were aware about the claims filling process. 79% knew about the grievance redressal process in case they were not satisfied with the services. About 50% of claims were settled within 7 days and 65% within 14 days of filing.

___________________________________________________________________

Theory: Mutuals work with a risk reduction approach.

Reality: We found that about three-fourth (74%) of all members had availed risk reduction services. Members who had goat insurance were supported with goat vaccination, sharing information on best practices of goat rearing and had access to a series of voice mails on goat rearing. Members who had health insurance in Pune & Mumbai had access to a bouquet of primary health services including regular doctor consultations, health navigation support, discounted medicines and diagnostic and tele-medicine.

95% members reported that mutual insurers were in regular communication with them through social media (Whatsapp), regular SMS, phone calls and monthly meetings.

___________________________________________________________________

In conclusion, it can be said that Indian mutual and cooperative insurers have mostly stayed true to the ‘text book’ mutual model. Strong community support and need based services have helped them remain relevant. There is a significant potential for these organisations to grow with 79% members expressing need for additional products such as asset, credit life and livestock insurance. Leveraging technology and digitisation could be a cost-effective way for these mutual and cooperative insurers to achieve scale and meet the untapped demand.

This research was developed as part of the Bharat Inclusion Research Fellowship.