Cash Management or Managing Cash?

Photo by O’SHI on Shutterstock.

In the last blog, we discussed about the need to understand financial lives of urban poor from their standpoint before devising financial products, services or tools for them. In this blog we’ll discuss some of the cash management strategies generally used by low-income households (LIHs).

Cash inflow management strategies of low-income households.

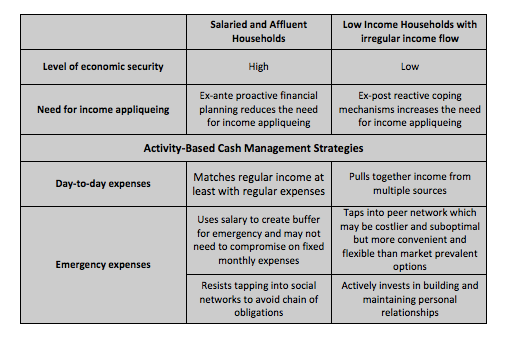

If you are reading this blog, it is likely that you are educated and can acquire (or possess) skills that can land you in a regular salaried employment with predictable cash flows, so much so that you can also plan for your retirement[1] (other than working in the gig economy which is a conscious choice sometimes based on resources available!). However, for LIHs the story is quite different, and we will discuss why. One of the major differentiating factors of financial management between these two types of households is that salaried households typically make ex-ante financial planning and management decisions, while irregular income earning households typically engage in ex-post coping mechanisms.

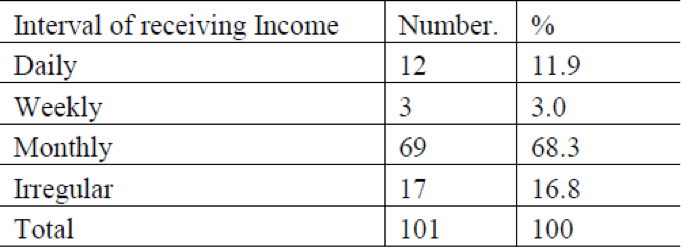

The concept of cashflow management in a household operates within the complex web of differently-timed goals, changing consumption patterns, employment opportunities, social network arrangements and unplanned shocks and uncertainties. In poor families money flows into the household at unpredictable frequencies and in inconsistent amounts. For example, a few years ago I found similar empirical evidence in an exploratory study[2] that I conducted to understand the financial lives of urban poor residing in slums of Mumbai. The study found that almost 32% of sampled individuals had irregular income flows. Added to that, households had sticky goals and aspirations which were short-term, long-term, and sometimes ad-hoc.

Frequency of Income:

Source: Dasgupta, M (2016). Financial Portfolios of Urban Poor: A study in greater Mumbai (MPhil Dissertation)

Let’s turn to look at some of the cash management strategies used by LIHs amid volatile cash flows (specifically cash inflows).

Moulding cash flow into the household

The word moulding, in its verb form, refers to giving shape or to influencing the formation of something. Extending this to household finance, income moulding for an affluent household would possibly mean getting a full-time salaried job and intelligently investing a portion of the money to accrue returns, while also building reserves for the future. In contrast, for a LIH, income flow is irregular, unpredictable, and a tremendous amount of mental energy is spent by the family in filling those gaps. One of the strategies that LIHs use to mould their income profile is, what I would call, a technique of income applique[3], wherein financial planning is more about arranging for money from various sources than about how to spend it.

LIHs usually have two ways of approaching income applique –

1. Pull together multiple income earning avenues to build the household income profile

One of the ways to income applique is through active job diversification. The concept of job diversification is more than just having multiple simultaneous jobs for augmenting cash inflows within the household. It is about using resources from one job (with slightly more stability but less security) and investing in another job such that the overall earning of the household is adequate to meet just the regular expenses. The cash flow of both the jobs may vary in frequency, payment, time cost as well as predictability. Though diversification may seem like a gamble where family members tend to overleverage their human capital capacity, from LIHs’ perspective the payoffs may outweigh the costs. An illustration of this in the urban poor context would be for a labourer to engage in construction work for significant portion of the day AND operate a small food stall in the evening.

It is also interesting to understand intrahousehold income smoothening through the gender lens. For instance, a study by Moser (2010)[4] on low-income families in Ecuador finds that “women often dovetailed their jobs or took-up casual jobs in direct relation to their husband’s state of employment or unemployment”. This observation is also prevalent in the Indian urban poor context where women from LIHs engage in wage earning activities either to compensate for their husband’s unemployment or to create a supplementary income stream. (On the brighter side, this does improve intrahousehold bargaining power for women!)

2. Draw liquidity from peer-based coinsurance

Job diversification works best when a) there are spare and casual jobs available in the market and b) when individuals can spend human labour and other resources to augment household earnings over a period of time. But what happens when LIHs are in sudden need of money which cannot be met by current liquidity, assets or savings? Given the vulnerable state of their livelihoods, the possibility of such situations is frequent, and the lack of foresight certainly exacerbates the impact of shocks. The preferred mechanism to overcome these shocks by LIHs has been to tap into social networks that include relatives, families, employers, moneylenders, shopkeepers or collective community-based fund raising arrangements. These networks are generally built out of shared geographies and work like life jackets that keep the family afloat without forcing them to drastically cut down their consumption levels or liquidate their assets. They are based on trust, reputation, empathy, flexibility and convenience. Anthropological literature has often tried to understand this complex coping strategy that is based on kinship or neighbourly ties. As Shipton (2011) puts it “lenders, like borrowers, should earn their trust. If the latter must earn by solvency and repayment record, the former must earn it by broader criteria, admittedly harder to measure: by moderation, by respect for borrowers’ dignity and autonomy, and by ecological responsibility, to mention only three.”

However, these arrangements can come with steep economic and social costs, particularly because the foundation of such transactions is driven by local systems of social hierarchies, caste, social class and location[5]. In addition, local communities may often face crisis at the same time; so tapping into networks may completely backfire at such times.

To summarize, cash management strategy for salaried households v/s households with irregular cash flows can be tabulated as below –

As aptly put by Zollman and Collins (2010)[6] “financial management is a constant, inseparable cycle of earning and allocating uncertain, erratic cashflows. This is matter of survival for some, and of comfort for others”.

For formal finance to enter and sustain in the lives of low-income households, it is a prerequisite to understand their daily grind closely. The goal to replace informal finance with formal finance may be cost-efficient from customer standpoint but may not be preferred by LIHs for reasons beyond economic utility. In this case, it could be beneficial to take cues from the services and devices used by LIHs and create or adapt existing products that suits their mental framework and financial fabric.

References and Endnotes

[1] Assuming you have no restriction on mobility, have reasonable access to IoT and have some amount of financial support (not necessarily though)

[2] Dasgupta, M (2016). Financial Portfolios of Urban Poor: A study in greater Mumbai (MPhil Dissertation). Retrieved from http://192.168.194.112/handle/1/7914

[3] Appliqué in this context is an analogy for creating an entire fabric (aggregate household income) out of smaller pieces of fabric (earnings from multiple sources). It can be considered as a subset of income smoothening. Also, income smoothening is different from consumption smoothening that involves borrowing, savings, accumulating and depleting physical assets, using formal and informal products and services of insurance.

[4] Moser, C. O. (2010). Ordinary families, extraordinary lives: Assets and poverty reduction in Guayaquil, 1978–2004. Brookings Institution Press.

[5] Guérin, I., d’Espallier, B., & Venkatasubramanian, G. (2013). Debt in rural South India: Fragmentation, social regulation and discrimination. The Journal of Development Studies

[6] Collins, D., & Zollman, J. (2010). Financial capability and the Poor: are we missing the mark. FSD Insights, 1–11.

This research was developed as part of the Bharat Inclusion Research Fellowship.