Building a Digital Twin for Mutuals

Image by pixelfusion3d on iStock

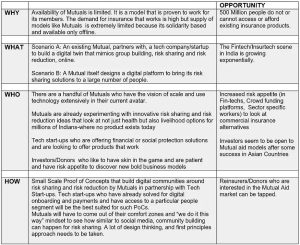

The Problem Statement

Mutual insurance models in India are extremely localised and at times exist at some scale in pre-formed communities such as Self-Help Group Federations(SHG). The existing mutual models take a long learning curve to build, and are exclusive (entry restricted by microfinance) and investment heavy. Most of the mutuals are inward looking, limited by their primary business, and are satisfied with their current outreach.

The current pace of digital infrastructure being built in India, whether it’s the India Stack, the Accounts Aggregator or the WhatsApp/Telegram based sachet delivery of financial products, brings a never-seen-before opportunity — to build a digital mutual insurance product on solidarity, as more and more people in India get connected to the internet and have smartphones.

The Solution

Building a digital twin that mimics grassroot Mutuals’ values, services and efficacy may be the best way to scale what works and unlock the value that mutuals can bring in bridging the massive gap in inclusive insurance in this country.

The Workings

This research was developed as part of the Bharat Inclusion Research Fellowship.