The Challenges of Rural Women Bankability

Rural women remain ‘formally’ ignored and irrelevant in the agrarian economy. On an average, they have lower levels of literacy, education, and land (assets) holding sizes than rural men. Their freedom within households and communities is limited too. While at the same time, women are more responsible for managing the household, raising the children, contributing to the rural economy (though their contribution often goes unnoticed). However, women’s lack of access to credit, the tools to run an agriculture season (supplies and equipment), and markets, hinder their productivity and potential: a potential that financial institutions can tap. The SHG (Self Help Groups) and Co-operative movement has taken an immense step in improving credit access to women. Interestingly the SHGs have been able to perform without seeking collateral or guarantees. But this success recipe is yet to be decoded with a formal lending organization.

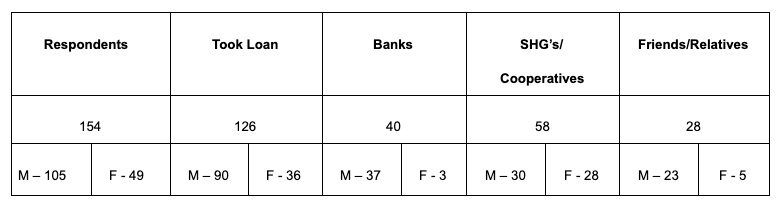

One interesting insight that popped up in our research project to find out how Farmer producer organizations (FPOs) affects the financial inclusion of its members — was the challenge around rural women farmers getting access to credit from formal institutions. In this process we interviewed CEO, Board of Directors, and farmer/non farmer members in the area of FPO. We consciously sampled a number of female respondents to understand the gender-related aspects. Out of 154 respondents 49 respondents were female (see table below).

This instigated us to learn the challenges faced by women farmers in getting access to credit from the formal institutions. One of the challenges in this regard included women having no formal assets which can be leveraged as a collateral. Women often get a piece of land to cultivate and undertake agriculture activities. These are verbal commitments and often not recorded in formal documentations. Most assets in the family are in the name of the male members, thereby making women handicapped when it comes to seeking formal lending. Furthermore the assets held by women are often smaller in size. In our sample group, the average land size held by men was 4.21 hectares and that held by women were 2.51 hectares. Lower asset size, often acts as a deterrent as the lending organisation doesn’t feel the collateral of sufficient value. Furthermore, with respect to documentation, there is a need for a referral/guarantor (non-family member) for sanctioning the loan. The socio-cultural fabric has not yet evolved to the extent where people from the community come forward to vouch for the women farmers.

During the discussion with women farmers, it was evident that a lot of the product/services are structured or designed from lending institute’s urban experiences. For instance, if a financial institution has had success with a loan product in urban areas, it cannot assume the same offering or methodology for assessing creditworthiness of an individual will fit a rural context. The most important feature of rural loans is that they need to be tailored to the needs of rural families. In order to tap the rural market, products and services have to be designed with rural women diaspora as the centre of focus.

As for now, the bankability of rural women would need a significant re-look to achieve gender inclusion or financial inclusion.

This research was developed as part of the Bharat Inclusion Research Fellowship.