It is better to be unique than the best

Photo by RawPixel on Shutterstock

“ It is better to be unique than the best. Because, being the best makes you the number one, but being unique makes you the only one.” Justice A.K Sikri announced his judgement on the writ petition of 2012 on Aadhaar’s validity on 26th September, 2018. On that day, Suresh was eagerly waiting for the extracts of judgement like all other fintech founders operating in India. Later, that day a critical change in the Aadhaar Act happened which made e-KYC using Aadhaar stack invalid, as section 57 of the Aadhaar Act was struck down. This amendment would not change much for a lay person, but for a fintech founder like Suresh, it was a monumental change.

Suresh is the founder of fintech start-up which enables instant access and immediate transfer of credit direct to bank accounts of loan seekers. The start-up uses Aadhaar based e-KYC to on-board customers, and then extends credit based services to them. The customer base of Suresh’s start-up majorly comprises low-income customers and rural immigrants doing humble jobs in cities. These customers have an existing relationship with banks as savings account holders. Government drives like Jan Dhan Yojana and renewed PPI guidelines have encouraged them to share various KYC documents with financial institutions.

Aadhaar e-KYC

Aadhaar based e-KYC approach towards on-boarding has enabled various fintech start-ups to lower their operating expenses by many folds; and provide an instant service fulfilment facility to customers. Traditional on-boarding processes require an agent to visit the customer and take a copy of all required documents, which is a resource intensive process in terms of manpower, time, money. Technological innovations to this process were critical to the fintech community and came in the form of the presence-less layer of India Stack. However, the new amendment to Aadhaar Act will compel start-ups to adopt the traditional route for their business continuity.

Is there a Way?

Therefore, cutting back to Suresh’s dilemma, we find that digitally accessing valid KYC details of customers is a huge challenge for Suresh’s business model in the aftermath of the verdict. To seek solution for this challenge, he needs to look outward and think whether there are any alternate frameworks in economic areas where common identity stacks like Aadhaar are absent. PSD2 might showcase one such potential way forward. Payment Services Directive 2 are a set of guidelines that financial institutions in SEPA (Single Euro Payments Area) area need to abide for enabling their financial products. PSD2 is making strides in the domain of open banking and has opened up numerous opportunities for new age financial institutions. New PSD2 directive allows third-party providers to access customer bank account data- based on the customer’s approval- to provide value-added services in the payments arena. This open financial framework and data sharing ecosystem will eradicate monopoly of few institutions on customer data.

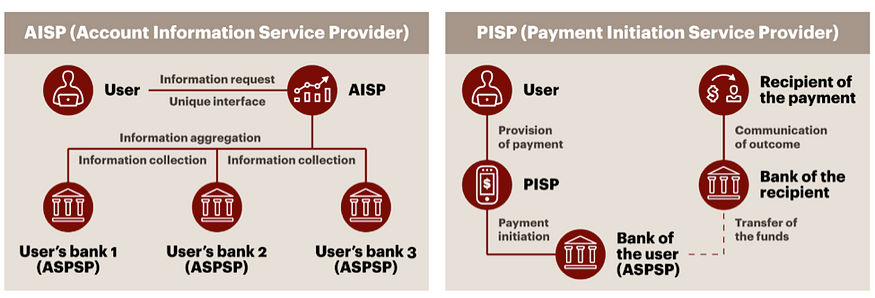

In addition to banks and building societies, payment and e-money institutions, PSD2 introduces two new classes of payment service providers: Payment Initiation Service Provider (PISP) and Account Information Service Provider (AISP), which are expected to provide new services under PSD2. For example, AISPs could provide aggregated bank account information and analysis services. PISPs, which “initiate a payment from the user account to the merchant account by creating a software bridge” could start to offer services such as bill payment and peer-to-peer transfers.

Fig: PSD2 access to accounts PISP and AISP (Source: A T Kearney analysis)

Open Banking for Suresh

Several banks in India have understood the power of open banking and its impact in increasing business. An open framework similar to AISP model can be a way forward for the challenges faced by fintech founders like Suresh. Adoption of this model will enable 3rd party institutions like fintech start-ups to collect KYC data of customers from their banks and complete on-boarding digitally. This process will require customer’s consent and will be similar to Aadhaar based e-KYC.

Open banking frameworks will empower fintech institutions and start-ups to a large extent by collaborative data sharing. In case of Suresh’s startup, a risk score needs to be checked before processing a loan. This framework will allow various banks to share their risk scores related to a customer; and help Suresh’s team to decide on transaction. This will enhance current risk scoring methodology and even provide an alternate risk scoring mechanism to CIBIL. PISP framework will even allow Suresh’s customer to source his loan from the bank of his choice and save that in a different bank of his choice. This will provide complete independence to the customer to select the best service on Suresh’s lending platform.

Open banking framework in India is still in nascent stage but possesses great opportunities for every stakeholder in the ecosystem. Challenges like the recent Aadhaar verdict will indirectly advocate the usage of open banking and speed up the process of open banking adoption.

P.S: Characters and fintech startup mention in this article are fictional and are being used for illustrative purpose only. Views on challenges and opportunities are collected from various fintech startups and SME (subject matter experts) in India.

This research was developed as part of the Bharat Inclusion Research Fellowship.