Insuring Bharat: Incremental Growth & The Long Road Ahead

Image by Uplift Mutuals

1. Insurance market — a fast growth, but for Bharat a long road ahead

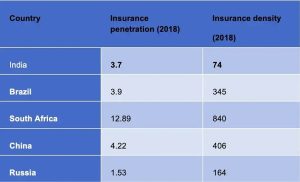

The Indian insurance market is growing faster than the global market. During 2018–19, the total insurance premium in India increased by 9.3 % whereas global total insurance premium increased by 1.5 %. However, we still have a lot of catch-up to do in terms of insurance penetration and density.

2. Health insurance — a few green shoots but huge concerns persist

Health insurance is the fastest growing segment in the Indian insurance sector with premiums continuing to grow over 20% YOY during the past four financial years. Still out-of-pocket expenditure on healthcare is one of the biggest reasons for people falling into poverty. As per the latest National Health Accounts (NHA) 2016–17, the out-of-pocket expenditure as a percentage of total health expenditure was 58.7%. While health financing is a mess, the health insurance industry is also not in good health either. The net claims ratio for the government health insurance scheme was 113% in 2018–19.

3. Microinsurance — regulatory obligation or business opportunity

All public and private sector insurers (other than standalone health insurers) complied with Rural and Social Sector obligations for the year 2018–19. However, incumbent insurers have to go a long way to meet the insurance needs of the majority. There are 600 million+ people still out of the reach of insurers and those with insurance are underinsured. Only 10.1% of the low and middle-income population is covered by microinsurance in India (not including the government insurance).

4. Innovations for Bharat — blinkered with primarily solving the distribution challenge while ignoring grassroot product needs

Major thrusts, towards standardisation and innovation in distribution have taken place using tech such as the IRDAI sandbox and recent equity investments in InsurTech companies. With the Indian populace being exposed to multiple livelihood risks there seems to be little innovation on the product side specially in microinsurance.

5. Mutual insurance — sustainable but not scalable due to high entry barriers

In the last two decades, community-based insurance models have demonstrated that it is possible to develop a sustainable people-centric insurance model. However, these people-led models face massive scaling-up barriers as the minimum capital requirement to secure an insurance license is INR 100 crores (US$ 13 million) in India. In most emerging economies and developed markets such as Brazil and Australia the minimum capital requirement is much lower: and instead depends on the spread of operations, risks covered etc.

The current state of insurance in India clearly shows that there is a need to go beyond ‘distribution as an issue’ mindset; and for a country the size and culture of India — create enabling policies for other forms of risk management such as mutual insurance.

This research was developed as part of the Bharat Inclusion Research Fellowship.