Byte the Coin — Designing Digital Money for Bharat

Photo by Tukaram.Karve on Shutterstock

Meet Deepak

“We can’t solve problems by using the same kind of thinking we used when we created them.” This Albert Einstein quote has deeply inspired Deepak to pursue his entrepreneurial passion and direct his drive towards the fintech ecosystem. Deepak is an engineer and a management graduate with a keen interest in the Indian fintech ecosystem. He has been passionate about solving problems, and has been especially fascinated by digital money from the very beginning of his career. The advent of pro-digital policies and regulations have encouraged him to closely pursue the domain and understand the nuances of how the fintech ecosystem affects modern banking. From his preliminary research, it has become evident to him that a significant section of the Indian population is either under-banked or completely lacks access to banking services. This has motivated him to initiate a project to develop a digital banking product for under-banked segments of the population.

Bharat and it’s New Challenges

Deepak understands that India is country where cash continues to play major role in banking. Yet at the same time, India has entered an era of digitization, where 4G services are being extended to the remotest parts of the country, digital governance is the new normal, and where payments are being redefined by e-wallet players. While such seismic changes in the ecosystem may have solved traditional problems related to uptime, service quality and transaction speed, they have also introduced a new set of challenges, like for instance, those concerning privacy and security. Wide geography and varied demographics of India make this a very interesting phenomenon, and one that beckons deeper understanding.

Deepak has adopted the trusted design thinking approach. A series of discussions with several under-banked individuals has led him to unearth various banking problems they face on a daily basis. He has found that majority of people in this segment earn in cash, spend most of their income on meeting basic needs, and save meagre residual amounts at home. Rural migrants who work in urban areas send money to their families living in the villages either via an agent or by depositing money in the account of a trusted bank account holder in the village. Formal money-transfer channels like banking correspondents, money order or speed post are too expensive for such individuals, even though they may be familiar with the procedures involved. Channels like internet banking and e-wallet, on the other hand, are perceived to be threat prone and cumbersome.

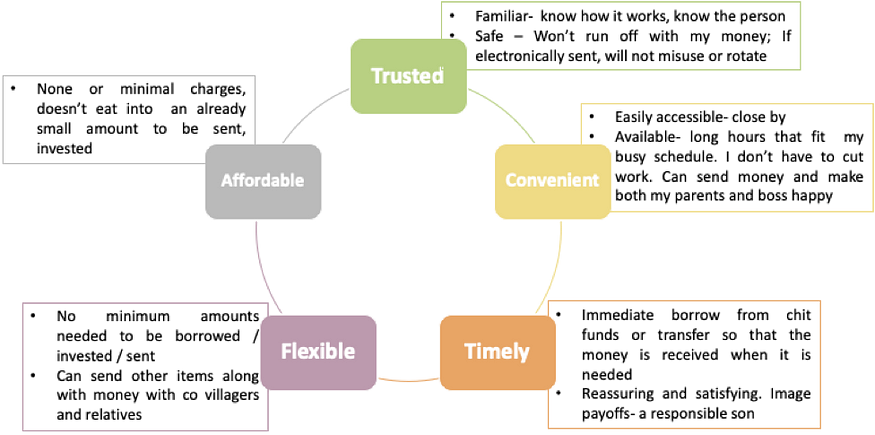

Preferences of under-banked people continue to align with informal methods of money management, where they rely on acquaintances or friends more than a bank branch. Deepak was able to map the factors and reasons accounting for said preferences. He summarized his findings in the figure below (see figure 1).

Figure 1: Factors and reasons making informal methods a preference for money management

Thereafter, Deepak probed deeper into the context and tried to identify the major barriers that under-banked customers encounter in using traditional branch banking. He noted that the following were the most frequently reported issues-

1. Bank Staff: Evoke feelings of anger and frustration

Several customers interpreted rude and dismissive behaviour of officers as a show of superiority. They felt that bank staff did not related to them and hence, were incapable of solving their daily banking needs.

2. Bank Technology: Feeling of embarrassment and fear

Majority of under-banked customers were less conversant with technology. Simplest of banking procedures like using a passbook update machine or an ATM had the potential to become source of public embarrassment in the event of a mishandle.

3. Bank Procedures: Feeling of frustration

At numerous instances customers resisted visiting bank branches to avoid waiting in long queues at the bank, dealing with change of bank personnel (the familiar person has moved out), or on account of tedious procedures, fixed timings, lack of awareness about rules and regulations (e.g. accounts close if balance falls), fear of filling out forms, inadequacy in understanding formal languages etc.. As a result, they were dependent on assisted models, where they needed someone to assist them at each step. These reasons combined with absence of banking assistance was noted to cause frustration.

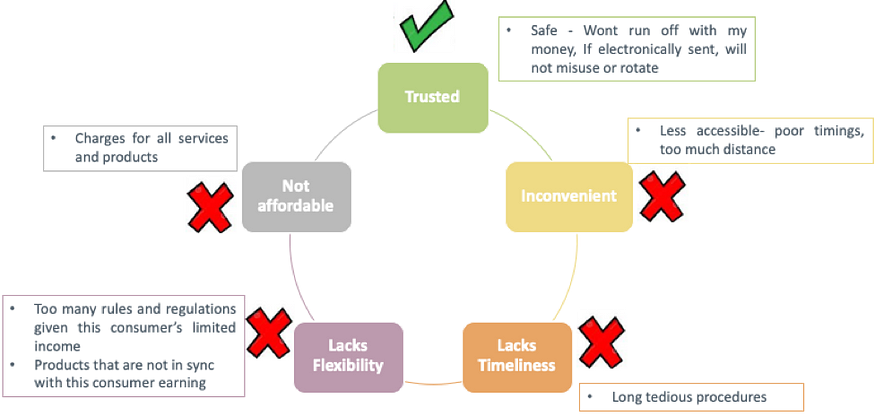

Deepak summarized his observations in the following figure (see figure 2).

Figure 2: Factors and related reasons making branch banking unpopular method

Designing for the Present and Unlocking Future Potential

To recapitulate, an immersive study to understand the problems of under-banked customers in India has unlocked various insights for Deepak, in a way that will help him craft a product without personal biases. Post this analysis, Deepak has come up with the following principles for designing a digital banking product for under-banked or unbanked segments of the population in India-

1. Functionality First:

People with low-literacy are used to problem solving. They create workarounds so that technology can better meet their needs and they are really good at this. Their resilience comes from overcoming painfully steep learning curves, put in the way by technology that just hasn’t considered users in an emerging space like digital banking. As product developers, we need to create a more inclusive experience rather than either a minimal or an overly complex journey towards the fulfilment of their banking needs.

2. Reality Always Wins:

Force fit approach to banking products designed for urban elite will not work for the under-banked segment. Letting go of our original assumptions will make room for critical user-driven insights, which is an essential practice if we’re to help users transition to new behaviours and improve their digital fluency using new age banking products. Cultural, economic and demographic gaps in various consumer segments will lead to different significant needs and understanding them will allow us to develop successful banking products.

3. Design for Unpredictable Customer Journey:

As product developers for the under-banked and unbanked population in India, one has to be extremely creative in handling unpredictable situations which can act as dead ends for users. Situations like power failure, connectivity issues, cyber-security disputes etc. might alter the intended customer journey through a product. This can lead to mistrust and permanent disapproval of technology. Hence, a thorough analysis of all possible dead ends will allow us to create an inclusive and trustworthy digital banking product.

Deepak’s Take on Developing Digital Banking Products

At this leg of his journey as an aspiring entrepreneur, Deepak has a few words of caution to share with product developers designing for financial inclusion. He emphasises- As we design new digital banking products and services for under-banked and unbanked segments, we’re inviting them to take a risk- it might be doing away with paper receipts and moving towards digital, or trusting that their money won’t disappear if they put it on their phones. These first experiences are extremely delicate. Getting them wrong could mean turning vulnerable people away from all the benefits that new age technology can give them. Achieving inclusive digital banking means that as product developers, we have to actively understand our biases and let the voice of users define what successful a product looks like.

P.S: Deepak in this article is a fictional character. Insights and experiences shared in this article are derivative of research being done by authors in the domain of open banking and financial inclusion.

This research was developed as part of the Bharat Inclusion Research Fellowship.