Developing Sustainable Financial Access for MSMEs

Photo by GCShutter on iStock

Micro, Small and Medium Enterprises form the backbone of manufacturing sector of India. Roughly there are 65 million MSMEs in the country across Service and Manufacturing sectors. This sector is vast and diversified. Combined together, the MSME industry is the largest contributor of employment in the country, attributing to around 25% of the working population (1).

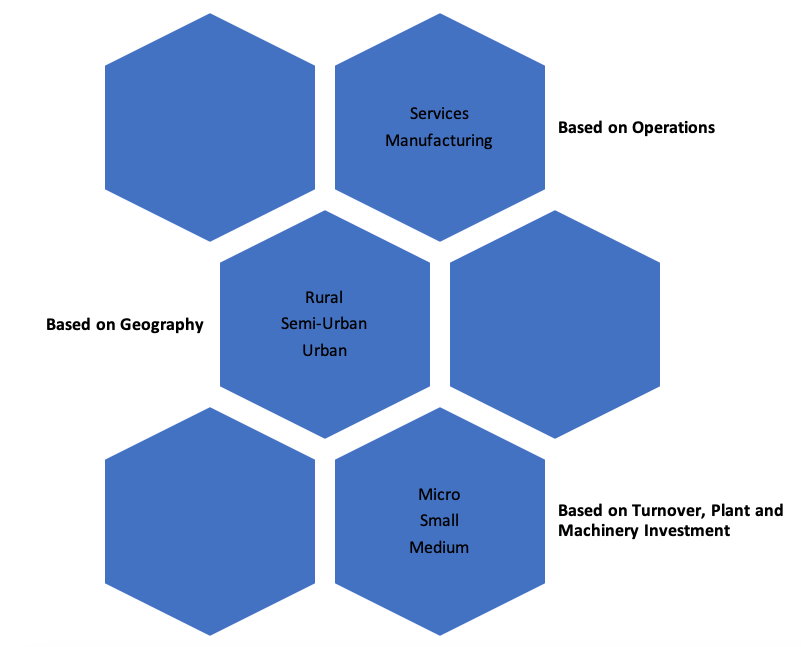

Enterprises are classified according to different nomenclature into following (2)-

Each MSME is unique, has its own business competency and understanding, some have definite competitive advantage while others may not; some offer product positioning while many are just one among the hundreds and are in perfect competition; some have skilled workers while others have unskilled workers, there might be organisational stewardship only in handful while most would be run with limited thought process. With all these qualitative differences, comes the differences in their size and scale of operations, turnover, profitability and cash flow, which are more quantitative. Hence, it has been a sector with wide divide in terms of financial access and also technological access. Financial, Informational and Technological (now referred as FIT) asymmetry has also been a showstopper among Indian MSMEs, which otherwise have the potential to bloom into a better contributor to the GDP of the country. At present, MSMEs contribute to around 30% of the GDP in the last decade. With agriculture’s contribution to GDP reducing year on year, MSME is the space that one needs to promote for better employment opportunities and more widespread development of our economy.

MSMEs become more relevant today with the explosion of the pandemic situation across the globe. Self-sufficiency is the new mantra. Atma-Nirbhar Bharat Initiative in the long term would encourage MSMEs to take off. However, the short and medium term effect of the pandemic is that it would weaken the MSME sector — with many studies suggesting that anywhere between 30% to 70% of MSMEs would shut down depending on the severity of the outbreak.

In this context, we embark as a team of researchers and professionals working in the domain of financing the MSMEs, with a clear goal in mind to build resilience to the sector. This would lay a sound foundation for a better MSME segment in the post CoVID 19 era. Our research’s key areas include –

1. Making the UnFIT to be FIT

- Bridging the gaps in information i.e. data through technology and thus provide financial access to the MSME

- This will increase the participation of formalised Finance sector to lend not mere 16% of the addressable INR 69 Trillion debt demand in the sector but more (3).

2. Building a framework for macrocosm between financial institutions which would strengthen information and data exchange for hassle free and fool proof credit assessment for micro and small enterprises.

3. Identify important clusters in the study states and create a generic credit rule engine that could be easily replicated across geographies and enterprises of different scale.

4. Build ‘Credit Risk Algorithm’ framework to facilitate creation of sustainable green field enterprises with better financial access mechanisms.

References

(1) According to CRISIL there are 46 Cr workers in the country of which approximately 12 Cr are employed in MSME according to MSME Annual Report 2018–19 which constitutes around 25% of the total working class

(2) Geographical Tiers are as per the RBI Classification of Pin codes as Rural, Semi-Urban, Urban and Metro. Rural is with population of <10K, Semi-Urban is with population of 10K to 1Lakh, Urban is with population of 1 Lakh to 10 Lakh, Metro is greater than 10

(3) IFC Study on Financing India’s MSME — Estimation of MSME Debt

This research was developed as part of the Bharat Inclusion Research Fellowship.