Insuring Bharat: Scaling Up People Led Risk Protection

Image by Uplift Mutuals

Rakesh, a 25 year-old from Kranti Nagar Chawl in Mumbai works as a valet in a food delivery platform. His average monthly income is around Rs 17,000 with which he supports a family of three — his elderly parents and a younger sister. His monthly expenses primarily include food, house rent, electricity and water charges. On an average he is able to save Rs 2,000 per month. He is saving for his sister’s marriage. Last monsoon (August,2019) there was an outbreak of malaria in his locality — his mother and sister, both suffered — thus requiring multiple doctor visits, over the counter medicine purchase and hospitalisation of his mother. The overall expenditure was around Rs 20,000, nearly wiping off his entire year’s savings.

Rakesh and his family do not have health insurance. With the coronavirus pandemic his earnings have dropped drastically and a similar health event this monsoon may wipe off all his savings and force him to borrow at high interest rates.

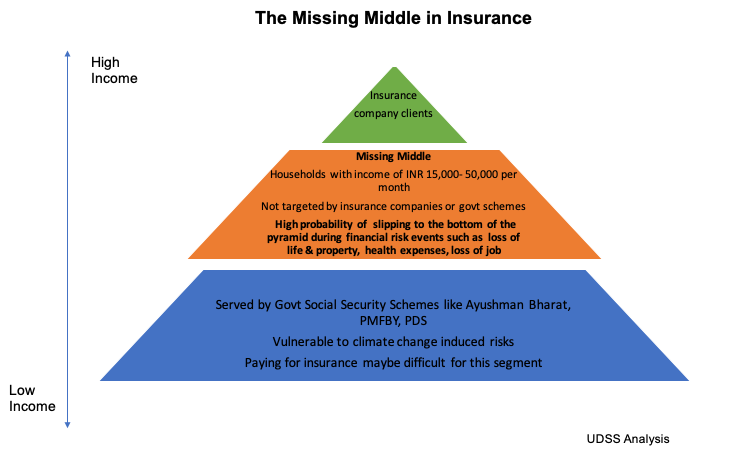

In India none of us are stranger to these stories, millions of Indian households fall in the ‘missing middle’ of insurance — neither covered by government schemes nor insured by insurance companies.

Community based insurance or as known in the insurance parlance ‘mutual insurance’ could be a viable alternative model to insure this vast segment that has the ability to pay but has not been tapped — the missing middle.

We at Uplift Mutuals are studying how mutual insurance can be scaled up to improve access to insurance.

A mutual insurance company is entirely owned by the policyholders.

- It is a bottom ups model of insurance; where risk is not transferred to an insurance company but retained by the community.

- The focus is to design & deliver need-based products; to protect members during a risk event. For instance, in this case Rakesh and others like him — the majority of health expenses is on doctor visits and over the counter medicine purchase then a viable health insurance product could be designed to cover this risk.

- They work with a risk reduction approach. For instance, if Rakesh was a member of a mutual insurance scheme, they would have focussed on reducing the risks of malaria amongst their members by timely fumigation, awareness etc.

- Any surplus earned by the company is either retained within the company or shared with the policyholders as dividends or as reduction in premiums.

As per a 2017 study, India has 15 MCCOs across 13 States, providing insurance services to approximately 1 million people in low income households using risk retention or risk sharing models. However, the biggest limitation of the current MCCOs has been their inability to scale-up. Our study will identify factors that have impeded the growth and scaling up of mutual insurance in India and provide a blueprint of how to develop a scalable and sustainable mutual insurance model.

This research was developed as part of the Bharat Inclusion Research Fellowship.